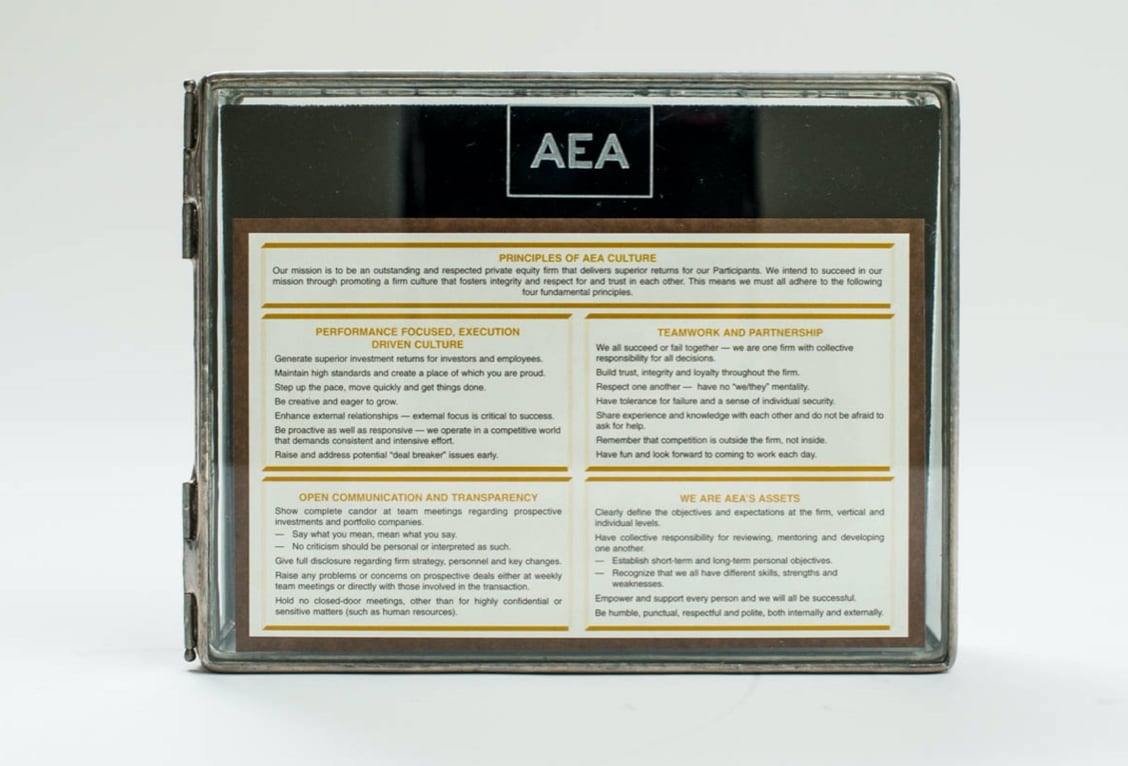

An Experienced Global Investment Partner

Founded in 1968 by the Rockefeller, Mellon and Harriman family interests and S.G. Warburg & Co., AEA has been positioning businesses for long-term success for over 55 years

A Unique Place In The History Of Private Equity

Over the last five decades, AEA has built an extraordinary network of the world’s leading industrialists, business executives and operators, many of whom join its portfolio company boards and/or act in other advisory roles. Combined with trusted, third-party resources for diligence and project support, the AEA network is an invaluable extension of the firm’s global footprint and knowledge base

In Assets Under Management

4

Complementary Investment Groups

300+

Current and Realized Portfolio Investments Since 2000

6

Offices Worldwide

120+

Global Investment Professionals

15+

Year Average Tenure of AEA's Investment Partners